D1🌐 Nasdaq and Gold weak, Crude up

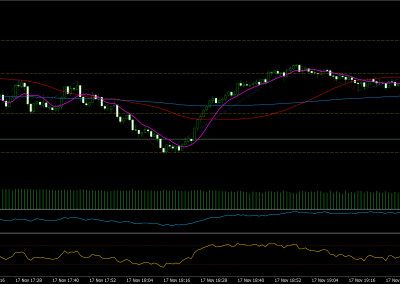

The entire Asian session was quite favorable for buyers, offering a nice start to the week—but without real volume. The same continued through the European session up until the US market open, where we saw a bull trap and a strong rejection. A very difficult session full of surprises, yet also a textbook example of how liquidity is taken and how undisciplined small players lose both their money and their confidence.

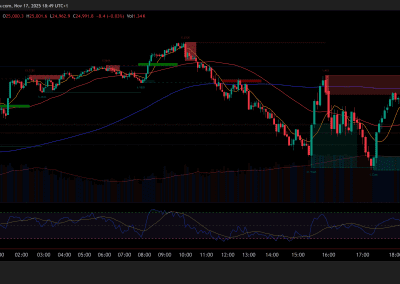

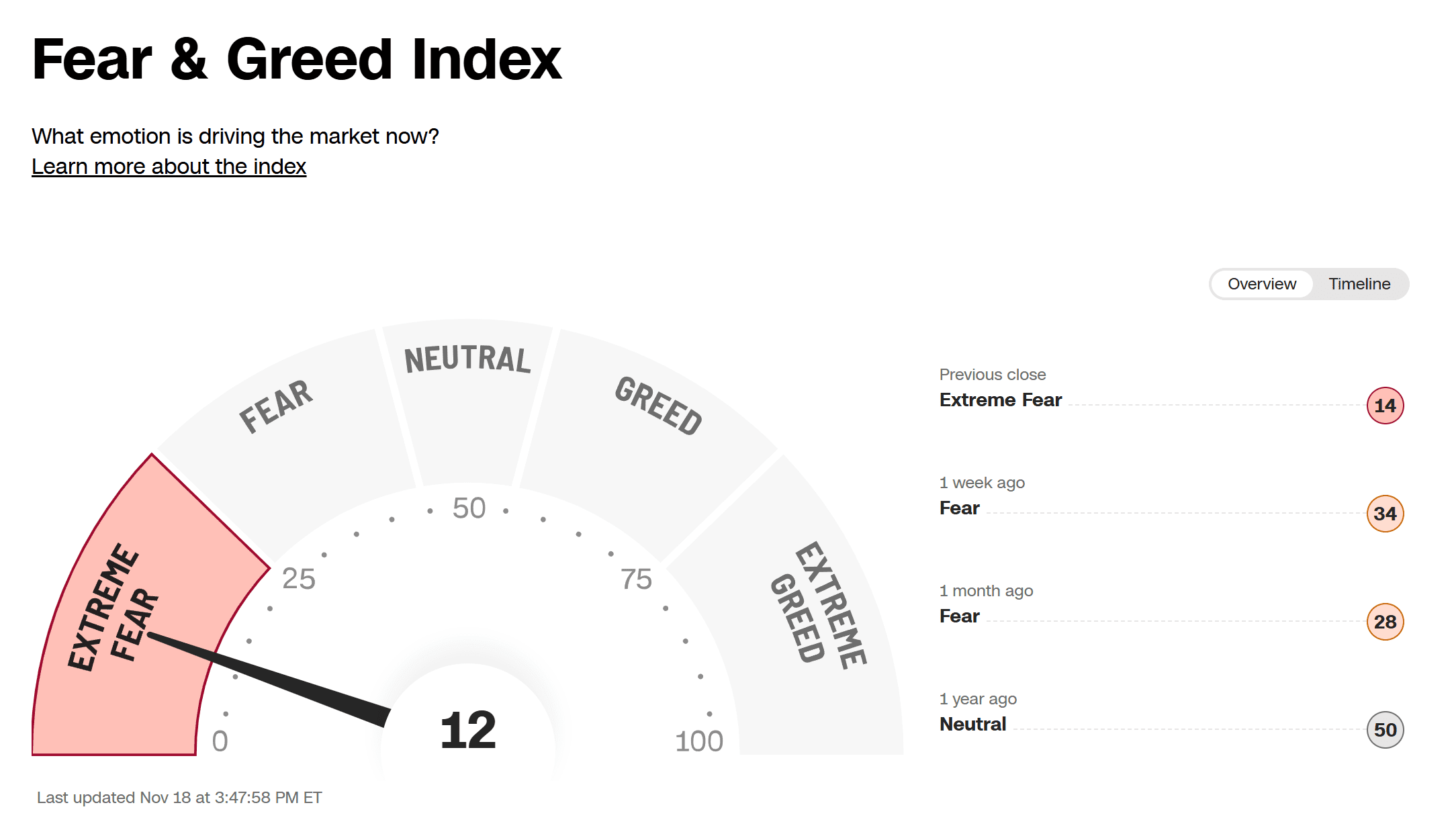

📅 Monday, 2025-11-17

A longer summary of the day:

The session started above Friday’s closing price and continued its run, but soon sellers stepped in, pushing the price back down to test the support level near Friday’s US session close before the start of the European session. Both Nasdaq and XAUUSD ended with a solid percentage loss, while oil fluctuated but eventually closed near its opening price.

Nasdaq offered great opportunities for disciplined traders who patiently waited for the market to weaken, since price action during the Asian session lacked conviction, and the first signs of rejection already appeared during the European session.

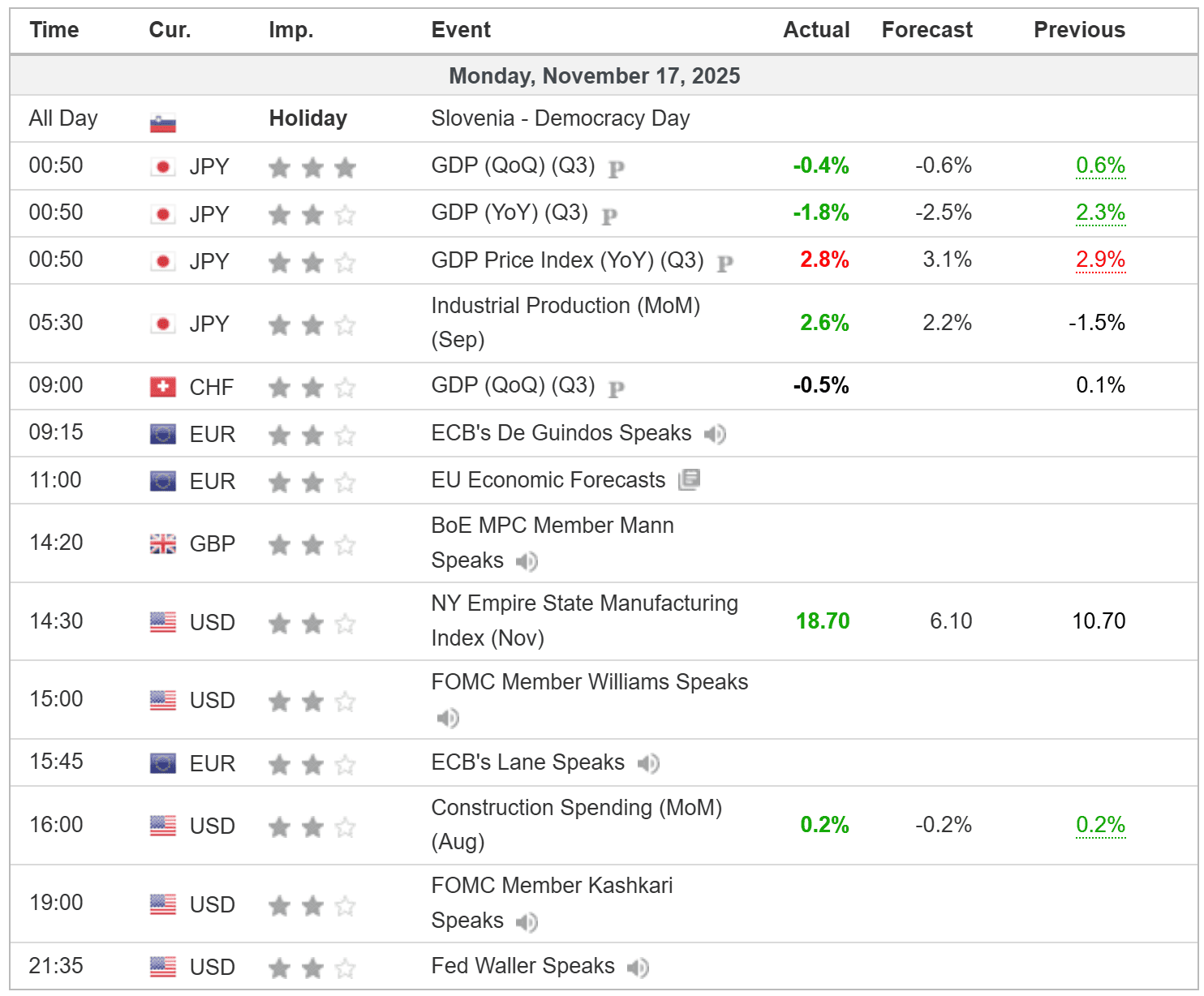

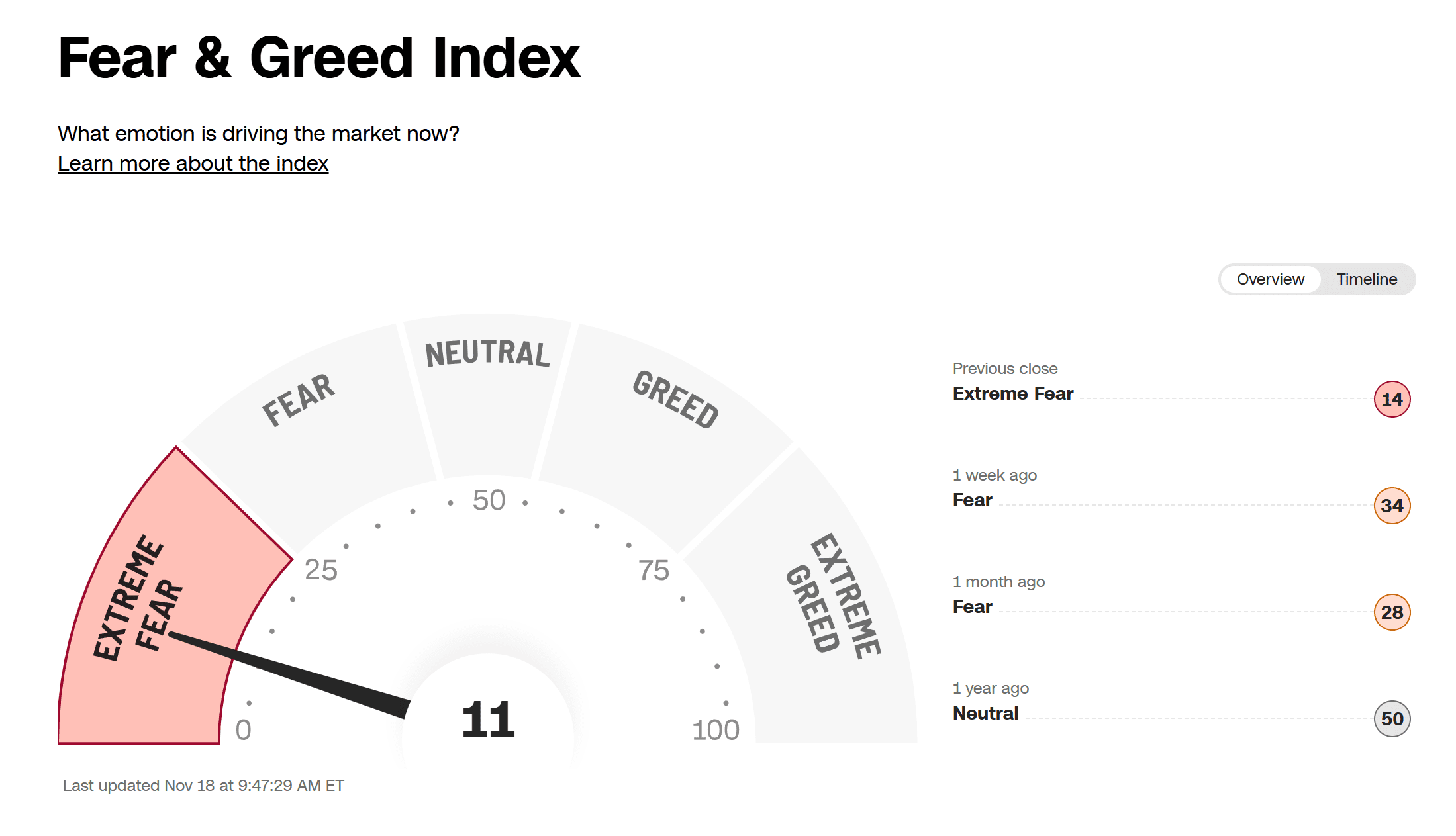

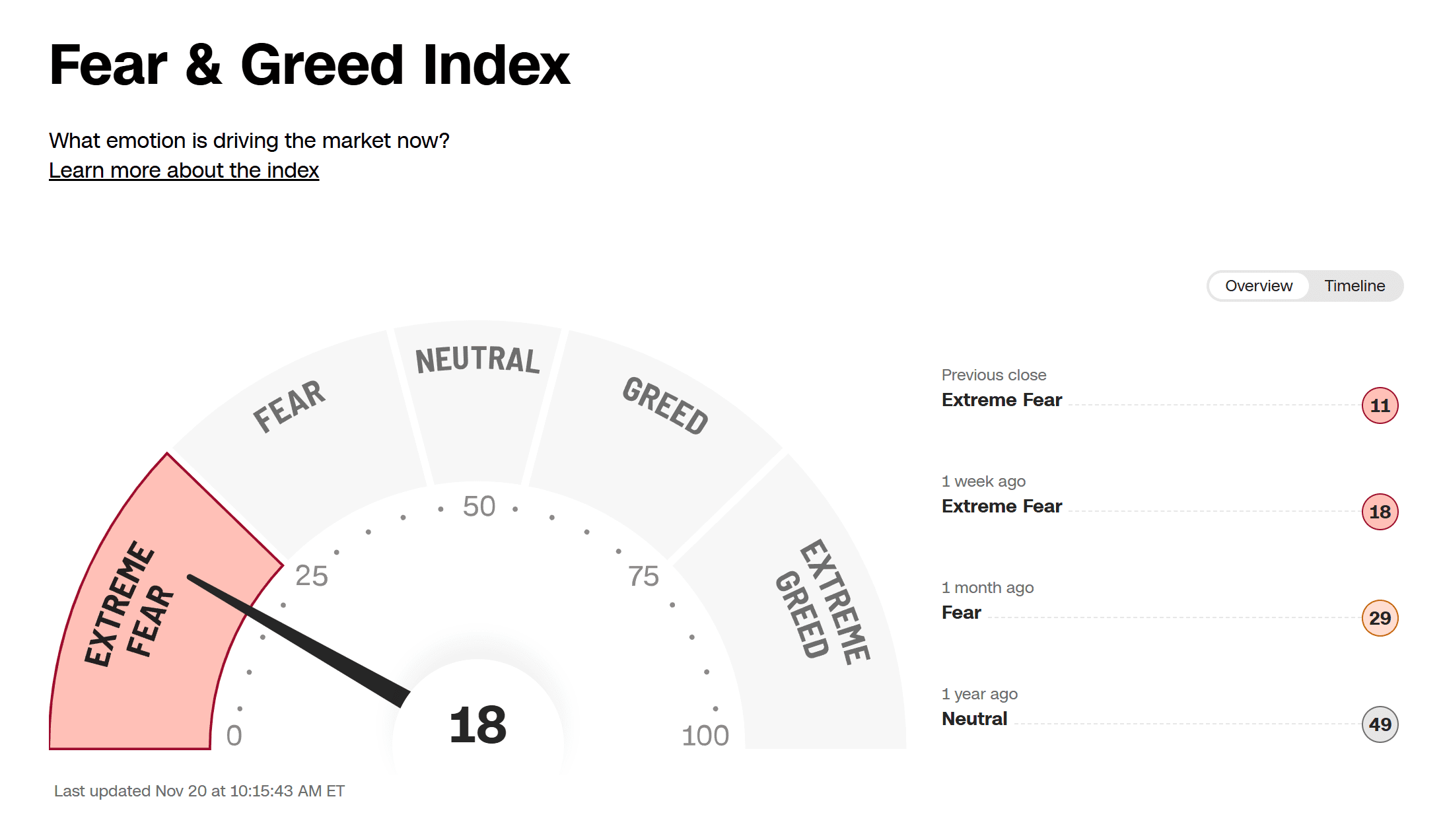

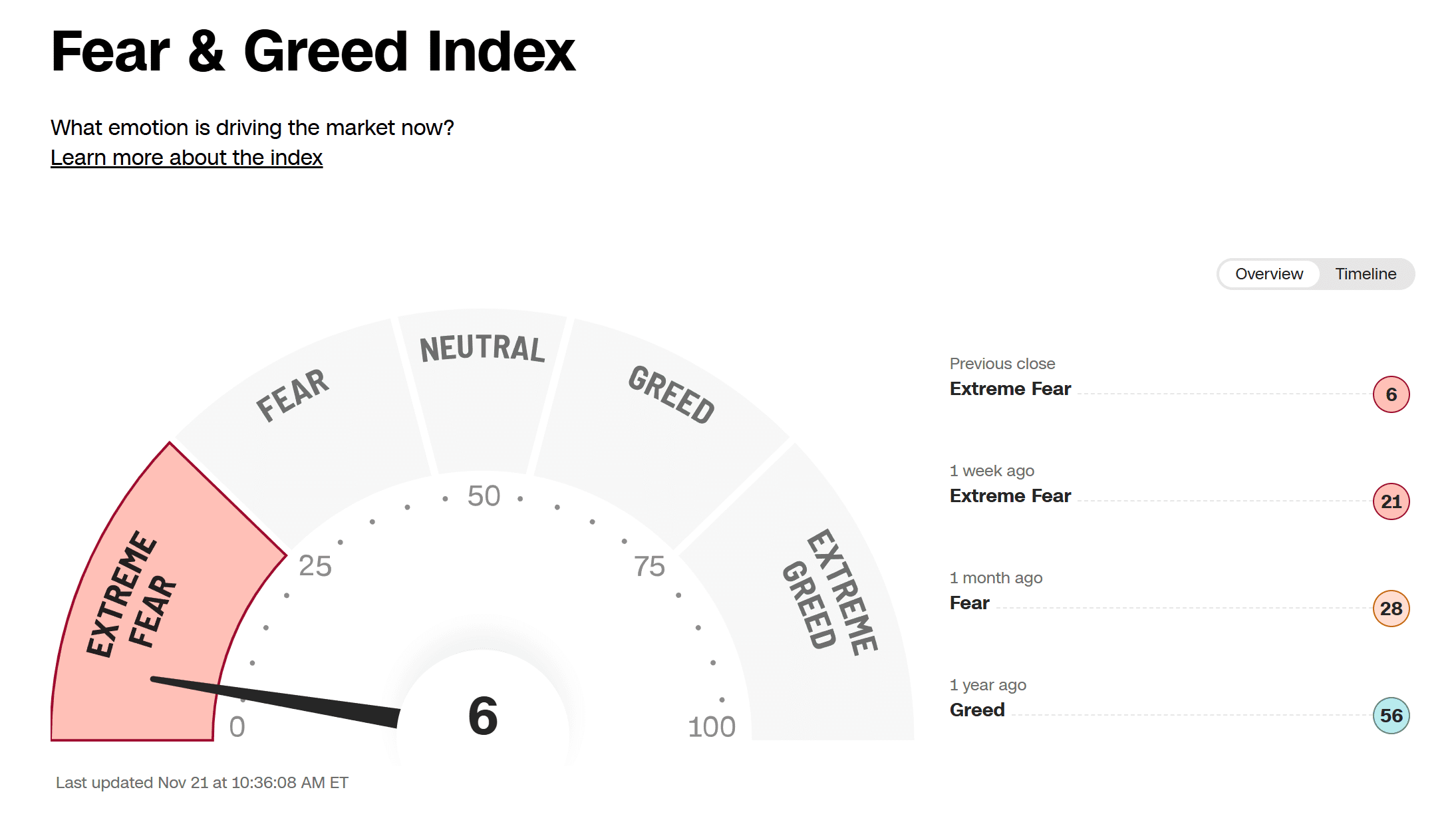

We must keep in mind that last week ended with strong selling pressure, which brought a deep sense of fear into the markets. Buyers are now uncertain about what’s next, so their activity was limited mostly to observation rather than participation. The Fear and Greed Index didn’t even exceed 13% at its peak.

At the moment, the best approach is patient waiting and occasionally taking advantage of larger short-term corrections with scalp positions—combined with solid money management and smaller positions that can be built upon once they move into profit.

🕒 Timeframe

1- and 5-minute timeframes for most of the day

🎯 Trade Type

Scalp trades

🔍 Market Context

Trading with patience and small lot sizes, adding only after a winning position is secured. Tight stop-loss applied.

⚠️ Key Levels

-

Support:

-

Resistance:

-

Additional zones or comments:

💡 Trade Setup

Patiently waiting for quick in-and-out scalp positions.

✅ Outcome

3 winning trades, 1 losing trade. Overall, a positive result.

📘 Lesson / Takeaway

Exited winning positions too slowly. Opened one position with an oversized lot — a perfect way to lose control!

🎯 Next Step

Stay more patient and wait for a larger correction. We could easily see a -12% pullback this week, following last week’s +9% move.

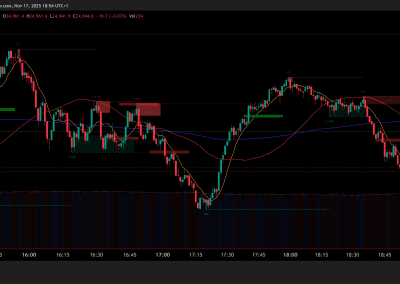

Chart gallery

Daily 1 minute chart quick price action review video

D2🌐 Nasdaq and Gold weak, Crude up

The entire Asian session was quite favorable for buyers, offering a nice start to the week—but without real volume. The same continued through the European session up until the US market open, where we saw a bull trap and a strong rejection. A very difficult session full of surprises, yet also a textbook example of how liquidity is taken and how undisciplined small players lose both their money and their confidence.

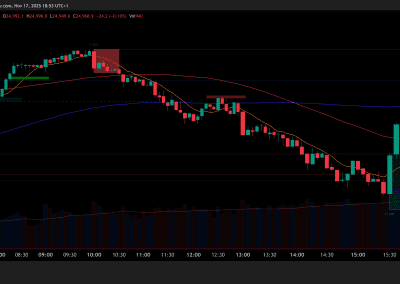

📅 Tuesday, 2025-11-18

A longer summary of the day:

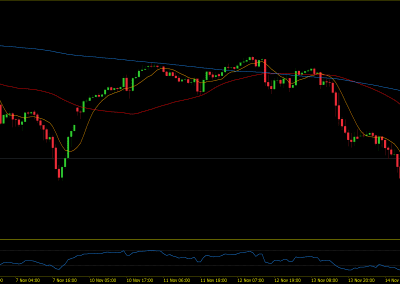

The session started above Friday’s closing price and continued its run, but soon sellers stepped in, pushing the price back down to test the support level near Friday’s US session close before the start of the European session. Both Nasdaq and XAUUSD ended with a solid percentage loss, while oil fluctuated but eventually closed near its opening price.

Nasdaq offered great opportunities for disciplined traders who patiently waited for the market to weaken, since price action during the Asian session lacked conviction, and the first signs of rejection already appeared during the European session.

We must keep in mind that last week ended with strong selling pressure, which brought a deep sense of fear into the markets. Buyers are now uncertain about what’s next, so their activity was limited mostly to observation rather than participation. The Fear and Greed Index didn’t even exceed 13% at its peak.

At the moment, the best approach is patient waiting and occasionally taking advantage of larger short-term corrections with scalp positions—combined with solid money management and smaller positions that can be built upon once they move into profit.

🕒 Timeframe

1- and 5-minute timeframes for most of the day

🎯 Trade Type

Scalp trades

🔍 Market Context

Trading with patience and small lot sizes, adding only after a winning position is secured. Tight stop-loss applied.

⚠️ Key Levels

-

Support:

-

Resistance:

-

Additional zones or comments:

💡 Trade Setup

Patiently waiting for quick in-and-out scalp positions.

✅ Outcome

3 winning trades, 1 losing trade. Overall, a positive result.

📘 Lesson / Takeaway

Exited winning positions too slowly. Opened one position with an oversized lot — a perfect way to lose control!

🎯 Next Step

Stay more patient and wait for a larger correction. We could easily see a -12% pullback this week, following last week’s +9% move.

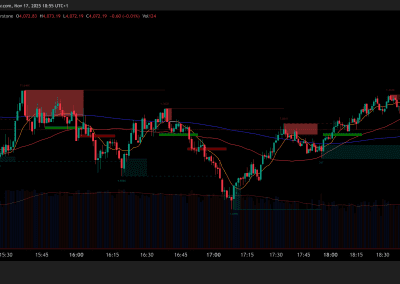

Chart gallery

Daily 1 minute chart quick price action review video

D3🌐 Nasdaq and Gold weak, Crude up

The entire Asian session was quite favorable for buyers, offering a nice start to the week—but without real volume. The same continued through the European session up until the US market open, where we saw a bull trap and a strong rejection. A very difficult session full of surprises, yet also a textbook example of how liquidity is taken and how undisciplined small players lose both their money and their confidence.

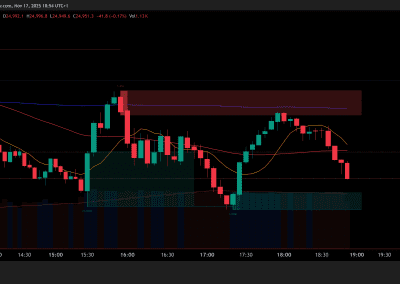

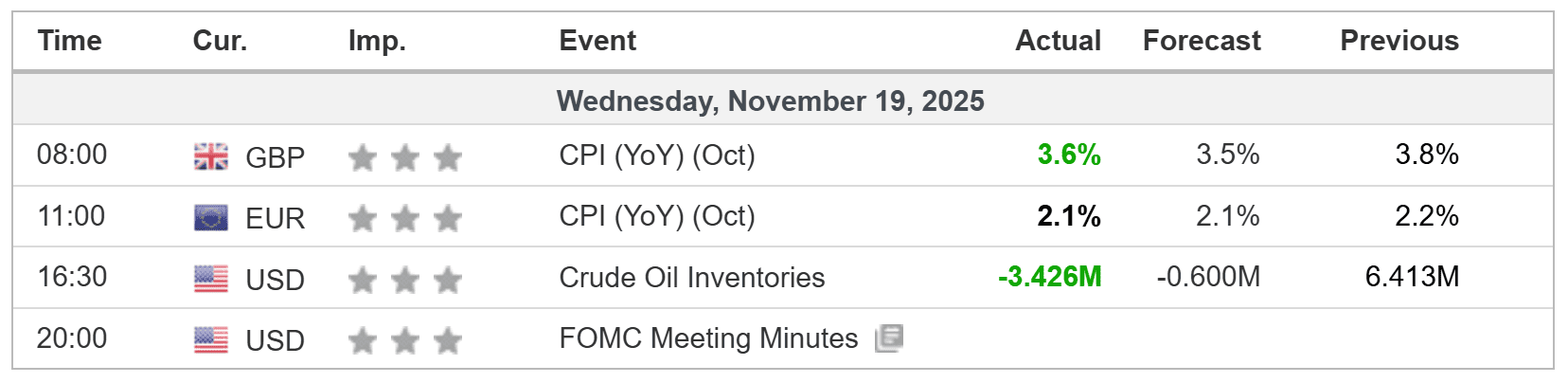

📅 Tuesday, 2025-11-19

A longer summary of the day:

The session started above Friday’s closing price and continued its run, but soon sellers stepped in, pushing the price back down to test the support level near Friday’s US session close before the start of the European session. Both Nasdaq and XAUUSD ended with a solid percentage loss, while oil fluctuated but eventually closed near its opening price.

Nasdaq offered great opportunities for disciplined traders who patiently waited for the market to weaken, since price action during the Asian session lacked conviction, and the first signs of rejection already appeared during the European session.

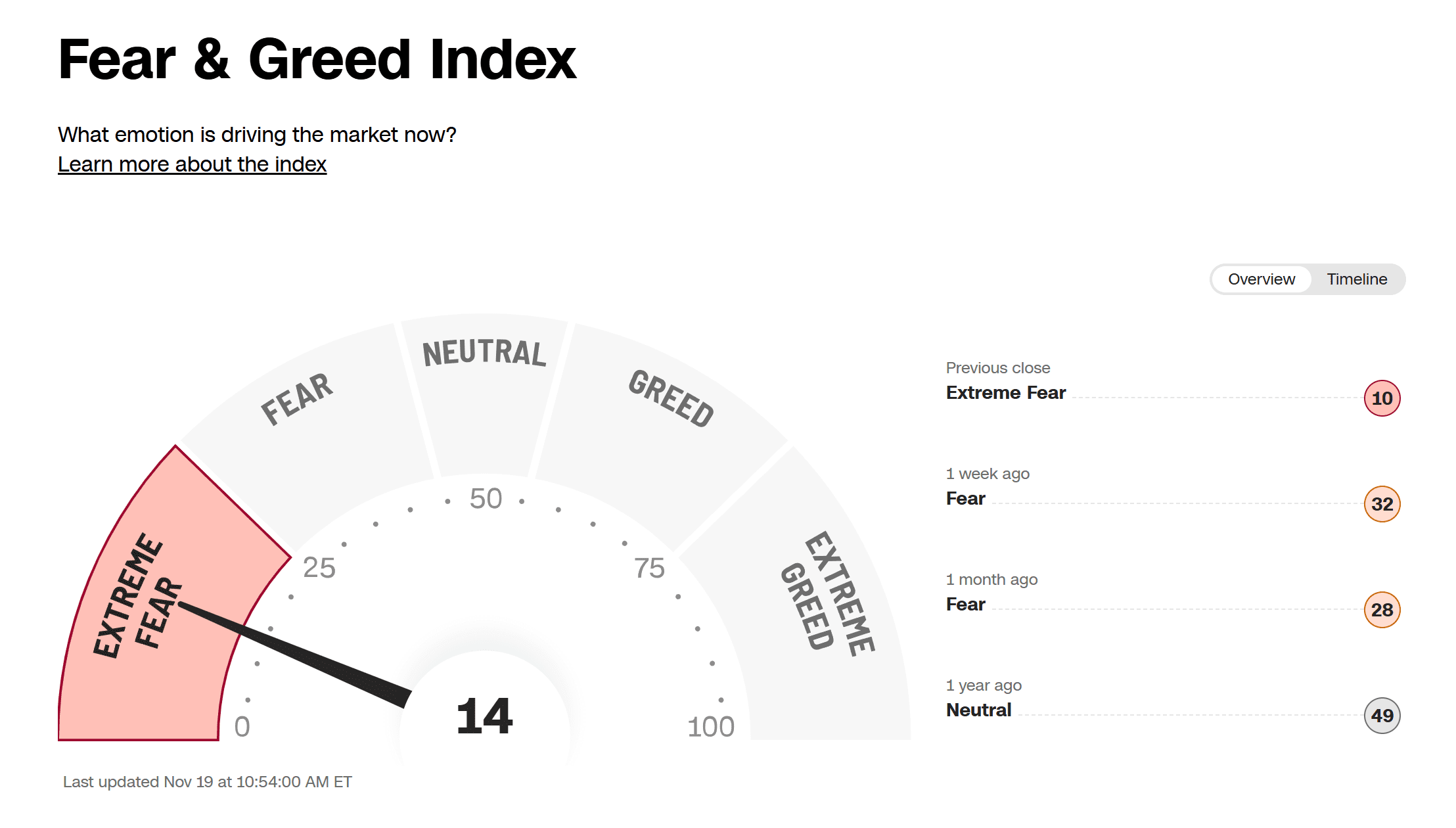

We must keep in mind that last week ended with strong selling pressure, which brought a deep sense of fear into the markets. Buyers are now uncertain about what’s next, so their activity was limited mostly to observation rather than participation. The Fear and Greed Index didn’t even exceed 13% at its peak.

At the moment, the best approach is patient waiting and occasionally taking advantage of larger short-term corrections with scalp positions—combined with solid money management and smaller positions that can be built upon once they move into profit.

🕒 Timeframe

1- and 5-minute timeframes for most of the day

🎯 Trade Type

Scalp trades

🔍 Market Context

Trading with patience and small lot sizes, adding only after a winning position is secured. Tight stop-loss applied.

⚠️ Key Levels

-

Support:

-

Resistance:

-

Additional zones or comments:

💡 Trade Setup

Patiently waiting for quick in-and-out scalp positions.

✅ Outcome

3 winning trades, 1 losing trade. Overall, a positive result.

📘 Lesson / Takeaway

Exited winning positions too slowly. Opened one position with an oversized lot — a perfect way to lose control!

🎯 Next Step

Stay more patient and wait for a larger correction. We could easily see a -12% pullback this week, following last week’s +9% move.

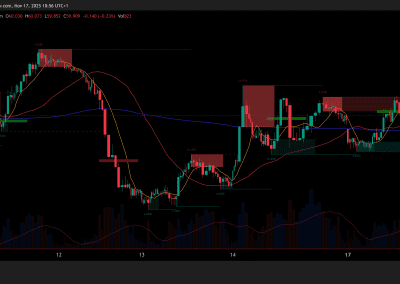

Chart gallery

Daily 1 minute chart quick price action review video

D4🌐 Nasdaq and Gold weak, Crude up

The entire Asian session was quite favorable for buyers, offering a nice start to the week—but without real volume. The same continued through the European session up until the US market open, where we saw a bull trap and a strong rejection. A very difficult session full of surprises, yet also a textbook example of how liquidity is taken and how undisciplined small players lose both their money and their confidence.

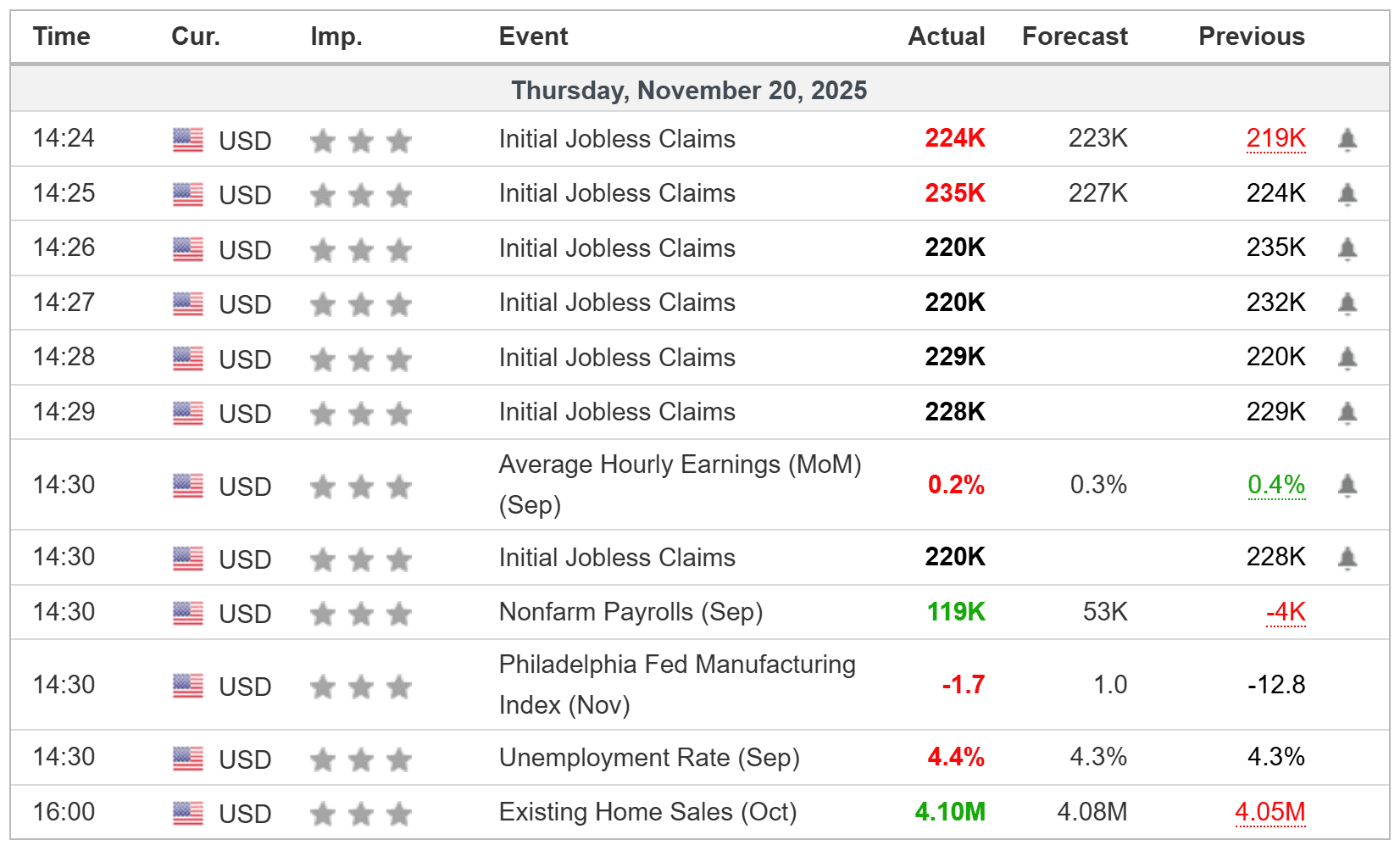

📅 Thursday, 2025-11-20

A longer summary of the day:

The session started above Friday’s closing price and continued its run, but soon sellers stepped in, pushing the price back down to test the support level near Friday’s US session close before the start of the European session. Both Nasdaq and XAUUSD ended with a solid percentage loss, while oil fluctuated but eventually closed near its opening price.

Nasdaq offered great opportunities for disciplined traders who patiently waited for the market to weaken, since price action during the Asian session lacked conviction, and the first signs of rejection already appeared during the European session.

We must keep in mind that last week ended with strong selling pressure, which brought a deep sense of fear into the markets. Buyers are now uncertain about what’s next, so their activity was limited mostly to observation rather than participation. The Fear and Greed Index didn’t even exceed 13% at its peak.

At the moment, the best approach is patient waiting and occasionally taking advantage of larger short-term corrections with scalp positions—combined with solid money management and smaller positions that can be built upon once they move into profit.

🕒 Timeframe

1- and 5-minute timeframes for most of the day

🎯 Trade Type

Scalp trades

🔍 Market Context

Trading with patience and small lot sizes, adding only after a winning position is secured. Tight stop-loss applied.

⚠️ Key Levels

-

Support:

-

Resistance:

-

Additional zones or comments:

💡 Trade Setup

Patiently waiting for quick in-and-out scalp positions.

✅ Outcome

3 winning trades, 1 losing trade. Overall, a positive result.

📘 Lesson / Takeaway

Exited winning positions too slowly. Opened one position with an oversized lot — a perfect way to lose control!

🎯 Next Step

Stay more patient and wait for a larger correction. We could easily see a -12% pullback this week, following last week’s +9% move.

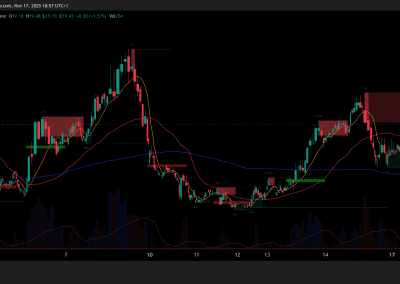

Chart gallery

Daily 1 minute chart quick price action review video

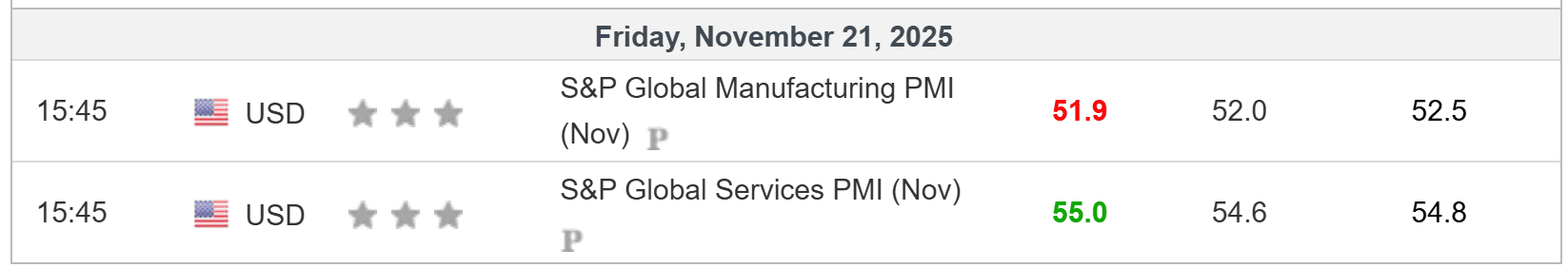

D5🌐 Fear stays all week

The entire Asian session was quite favorable for buyers, offering a nice start to the week—but without real volume. The same continued through the European session up until the US market open, where we saw a bull trap and a strong rejection. A very difficult session full of surprises, yet also a textbook example of how liquidity is taken and how undisciplined small players lose both their money and their confidence.

📅 Frinday, 2025-11-21

A longer summary of the day:

The session started above Friday’s closing price and continued its run, but soon sellers stepped in, pushing the price back down to test the support level near Friday’s US session close before the start of the European session. Both Nasdaq and XAUUSD ended with a solid percentage loss, while oil fluctuated but eventually closed near its opening price.

Nasdaq offered great opportunities for disciplined traders who patiently waited for the market to weaken, since price action during the Asian session lacked conviction, and the first signs of rejection already appeared during the European session.

We must keep in mind that last week ended with strong selling pressure, which brought a deep sense of fear into the markets. Buyers are now uncertain about what’s next, so their activity was limited mostly to observation rather than participation. The Fear and Greed Index didn’t even exceed 13% at its peak.

At the moment, the best approach is patient waiting and occasionally taking advantage of larger short-term corrections with scalp positions—combined with solid money management and smaller positions that can be built upon once they move into profit.

🕒 Timeframe

1- and 5-minute timeframes for most of the day

🎯 Trade Type

Scalp trades

🔍 Market Context

Trading with patience and small lot sizes, adding only after a winning position is secured. Tight stop-loss applied.

⚠️ Key Levels

-

Support:

-

Resistance:

-

Additional zones or comments:

💡 Trade Setup

Patiently waiting for quick in-and-out scalp positions.

✅ Outcome

3 winning trades, 1 losing trade. Overall, a positive result.

📘 Lesson / Takeaway

Exited winning positions too slowly. Opened one position with an oversized lot — a perfect way to lose control!

🎯 Next Step

Stay more patient and wait for a larger correction. We could easily see a -12% pullback this week, following last week’s +9% move.

Chart gallery

Daily 1 minute chart quick price action review video