WEEK 1🌐 First trading day of 2026 in red

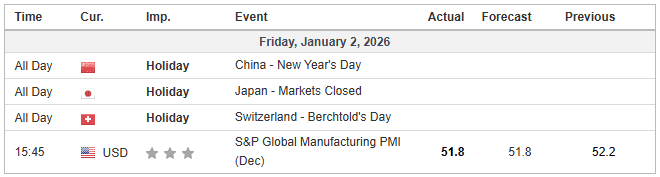

📅 Friday, 02 Jan 2026

A rough start to the year, entering the second week with optimism

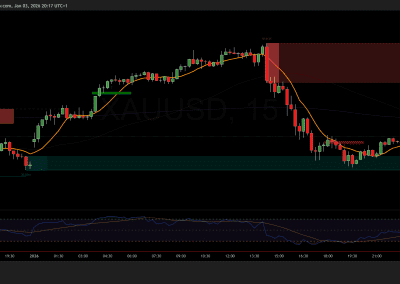

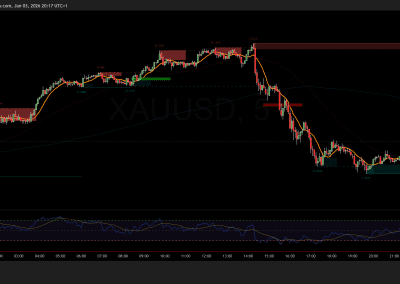

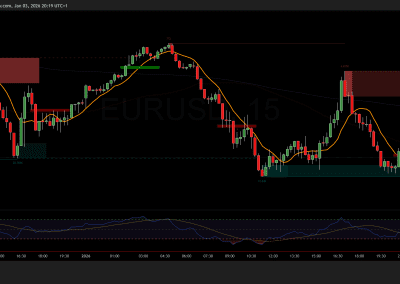

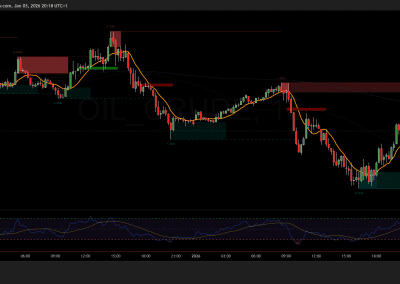

Throughout the Asian session and into the EU open, both XAU/USD and Nasdaq showed strong continuation. However, while gold and crude held their gains, Nasdaq turned bearish about an hour before the US open and stayed weak deep into the session. Only at the US market close did we see a glimmer of hope—leaving me cautiously optimistic for Monday’s open.

A longer summary of the day:

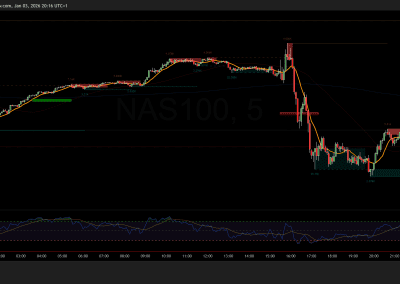

Nasdaq opened higher and consolidated until the start of the European session, when it experienced a notable drop just before the open. However, within an hour, the move faded completely — on low volume — and the price not only recovered but broke above the daily high, followed by a strong rejection. About 25 minutes later, the price fell by 0.8% and tested the daily low within the next hour.

Roughly an hour before the U.S. open, Nasdaq once again tested the daily high and gained new momentum as the U.S. market opened, but the move lacked real strength. Despite this, the price continued to rise slowly and steadily, increasing by about 1.4% from the daily high over the next two hours, again without significant volume. It was a steady climb with textbook examples of consolidation.

Two hours before the session close, the market transitioned into a sideways phase, which remained unchanged until the next European open.

Gold and crude oil both recovered nicely a few hours before the EU open, showing strong upward momentum. However, only crude displayed noticeable volume — gold, like Nasdaq, seemed to move mainly due to retail activity rather than participation from major players.

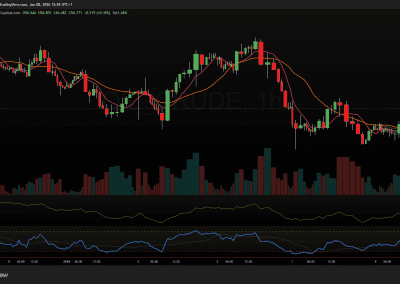

I decided to skip most of the day since I didn’t see any truly solid opportunities. I opened only one good scalp position on crude oil and closed it fairly quickly with a profit. A good day overall, despite the slow market behavior.

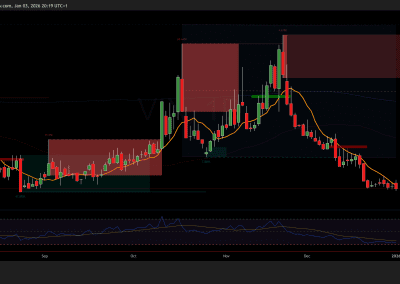

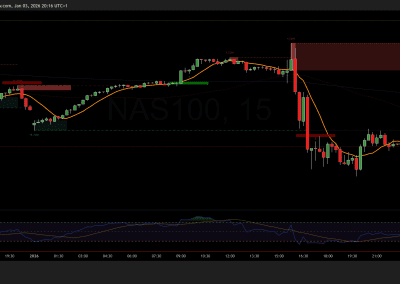

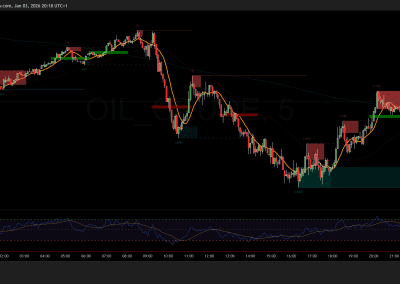

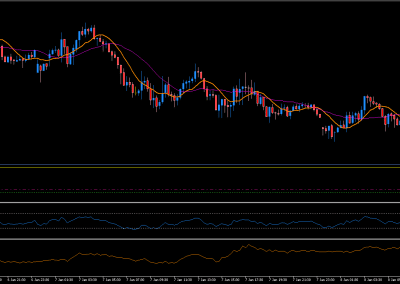

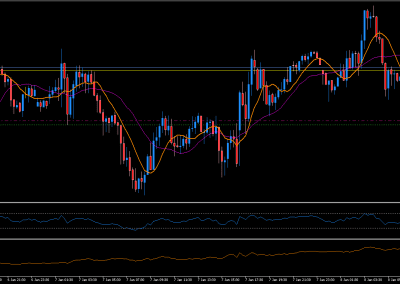

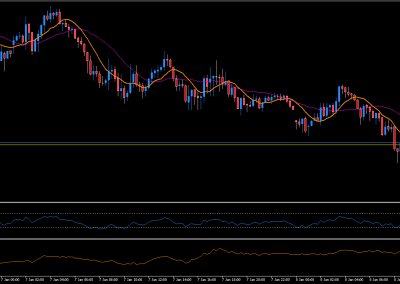

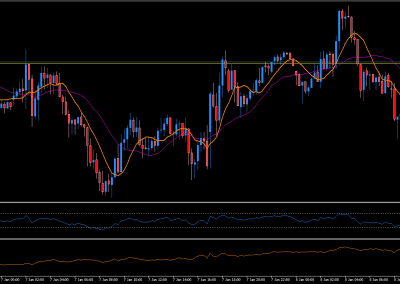

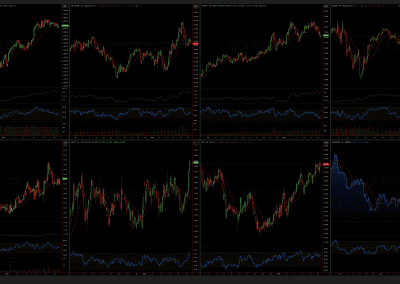

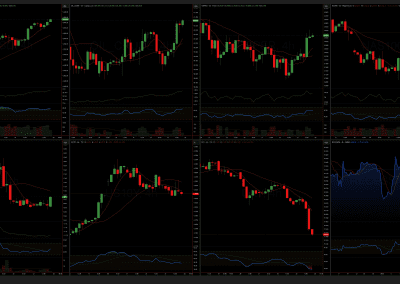

Quick visual overview of the day for major symbols

Trades of the day:

Timeframe

Only 5-minute timeframes or higher

Trade Type

Scalp trade

Market Context

Pullbacks on sell market.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, many trades, about 150 eur profit. One very BAD trade, but with small LOT so no big lose. I close position from fear.

Lesson / Takeaway

Too much waiting at the start of US session, didn’t hold A+ position from EU session.

Next Step

Stay in trade longer when I lock in profit.

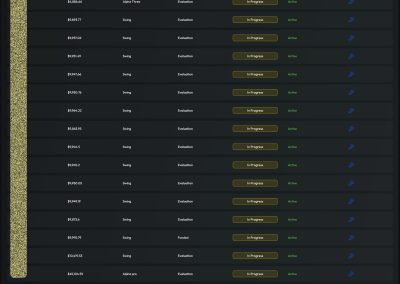

Quick taken positions overview

5 minute Candle chart quick price action review video

WEEK 2🌐 Bullish Expectations

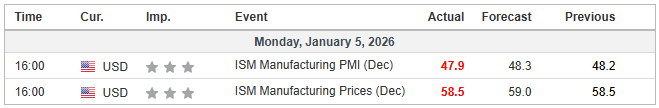

📅 Monday, 05 Jan 2026

Optimism validated

Gold Analysis: New Year Shakeout or a Launchpad to $4,550?

Welcome to my first technical deep dive of 2026. After a historic run in 2025, Gold (XAUUSD) started the new year with some “profit-taking” volatility. Let’s break down the charts and the macro environment to see where we are headed this week.

The Big Picture: Technical Health

Currently, Gold is trading around $4,332.70. While we’ve seen some selling pressure, the technical structure remains firmly bullish.

- On the daily chart, price is currently testing the 21-day SMA. In a strong uptrend, this is often the “sweet spot” for buyers to step back in.

- Gap Business is Finished: The liquidity gap created during the January 2nd open has been completely filled on the lower timeframes. With that gap closed, there is no longer a technical “magnet” pulling price lower.

- Hidden Strength in Accumulation/Distribution: Despite the price drop, the A/D line is staying flat and resilient. This suggests that “smart money” isn’t panicking; they are likely absorbing the sell orders from retail traders.

The Macro Backdrop

Gold doesn’t move alone. Here is what the surrounding markets are telling us:

| Market Metric | Value | Impact on Gold |

| U.S. Dollar (DXY) | 98.433 | Consolidating at resistance; a failure here would be fuel for Gold. |

| 10Y Treasury Yield | 4.195% | Staying below the critical 4.25% level, which keeps the bullish Gold thesis alive. |

| VIX (Fear Index) | 14.87 | Down 0.87%, showing that the market isn’t in a state of fear. |

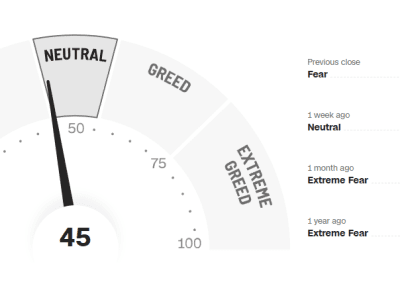

| Fear & Greed Index | 45 | Currently in “Neutral” territory, which often precedes a new trend leg. |

Two Scenarios for the Week Ahead

Scenario 1: The “Straight to the Top” (High Probability)

Since the gap is filled and the Friday “weak hands” have already been shaken out, we might not see any further downside.

- The Move: A clean break above $4,360.

- The Target: A fast rally toward $4,400, followed by a retest of the all-time high at $4,550.

Scenario 2: The “Liquidity Sweep” (Low Probability)

If there are still too many retail “buy” orders with stop-losses sitting just below the round number, we might see one final spike down.

- The Move: A quick dip into the $4,275 – $4,295 zone.

- The Result: This would be a “Stop-Loss Hunt” designed to grab liquidity before a massive reversal back up.

💡Final Thought

The first trading days of the year are always about positioning. Given that the macro fundamentals remain supportive and the technical “gap” is closed, I am looking for Gold to resume its climb. If we hold the Daily SMA 21, $4,550 is the magnet for the rest of the week.

A longer summary of the day:

Text goes here.

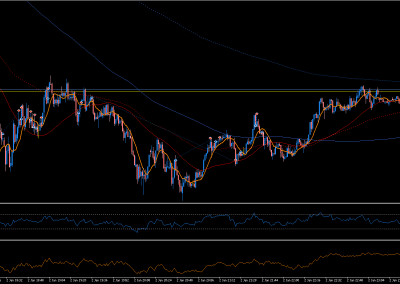

Quick visual overview of the day for major symbols

Quick taken positions overview

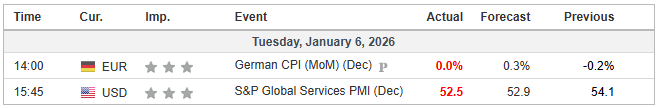

📅 Tuesday, 06 Jan 2026

A rough start to the year, entering the second week with optimism

Text!

A longer summary of the day:

Text!

Quick visual overview of the day for major symbols

Quick taken positions overview

Gallery description: If you see the thumbnail, I didn’t open any positions (Thumbnail = no trades).

📅 Wednesday, 07 Jan 2026

A rough start to the year, entering the second week with optimism

Text!

A longer summary of the day:

Text!

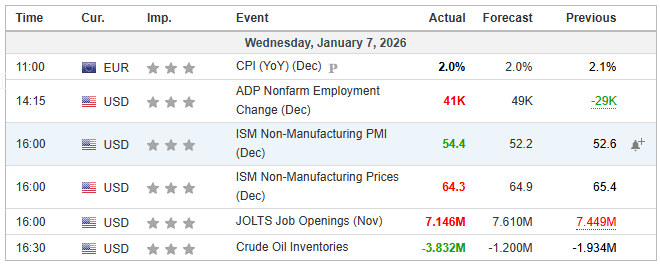

Quick visual overview of the day for major symbols

Trades of the day:

Timeframe

Only 5-minute timeframes or higher

Trade Type

Scalp trade

Market Context

Pullbacks on sell market.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, many trades, about 150 eur profit. One very BAD trade, but with small LOT so no big lose. I close position from fear.

Lesson / Takeaway

Too much waiting at the start of US session, didn’t hold A+ position from EU session.

Next Step

Stay in trade longer when I lock in profit.

Quick taken positions overview

📅 Thursday, 08 Jan 2026

Tight consolidation on xauusd, Crude testing support at 57$

Gold has been consolidating in a tight range throughout the EU session. I am expecting a significant expansion of volatility at the US Open. My plan is to wait for a clear breakout from the 15m range with high volume confirmation. I will stay disciplined on the 5m/15m charts and avoid the 1m noise.

A longer summary of the day:

😎Zlato je konsulidiralo vse do začetka us seje, ko je kmalu po vstopu po rahlem padcu našlo nekaj kupcev, vendar premalo in nisem odpiral pozicij. Preko jutranje eu seje sem vstopi po svojih planih v A+ setup in klodprl long pri 56.07 $ in držal do koncq 56.95$, vendar nisem pravočasno zaprl pol pozicije ročno zato je zaprlo celotno pozicijo. Plan je bil prodati pol in pustiti trade do 57.5, kar se je izclo brez mene (aplikacija ne podpira nastavitve). Nasdaq je dobil podporo kmalu po večjem pullback-u in Iskal sem long pozicijo, ker je kljib močnemu padcu F&G padep le za 1 točko, kar pomeni, xa je zdravo pobiranje profitov in ne velik sell na žalost pa sem se javil na telefon in zamudil priložnost za A+ kratkoročno long pozicijo. Telefon naslednjič na flight mode. Overall bi ocenil dan kot dober.

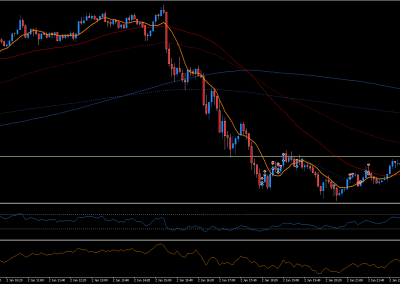

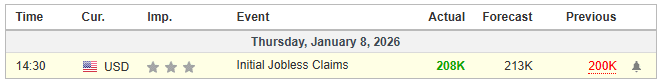

Quick visual overview of the day for major symbols

Trades of the day:

Timeframe

Only 5-minute timeframes or higher

Trade Type

Scalp trade

Market Context

Pullbacks on sell market.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, many trades, about 150 eur profit. One very BAD trade, but with small LOT so no big lose. I close position from fear.

Lesson / Takeaway

-

Suppressed the urge

-

Maintained my conviction

-

Discipline over emotion

Next Step

Stay in trade longer when I lock in profit.

Quick taken positions overview

📅 Friday, 09 Jan 2026

A rough start to the year, entering the second week with optimism

Text!

End-of-Day Review:

Title text!

Text!

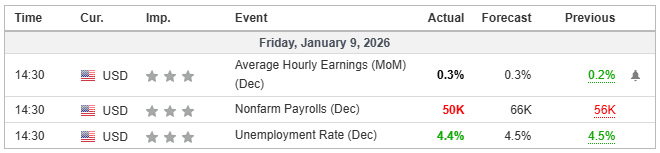

Quick visual overview of the day for major symbols

Daily Trading Reflection:

Timeframe

Only 5-minute timeframes or higher

Trade Type

Scalp trade

Market Context

Pullbacks on sell market.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, many trades, about 150 eur profit. One very BAD trade, but with small LOT so no big lose. I close position from fear.

Lesson / Takeaway

Too much waiting at the start of US session, didn’t hold A+ position from EU session.

Next Step

Stay in trade longer when I lock in profit.

5 minute candle chart quick price action video

WEEK 3🌐

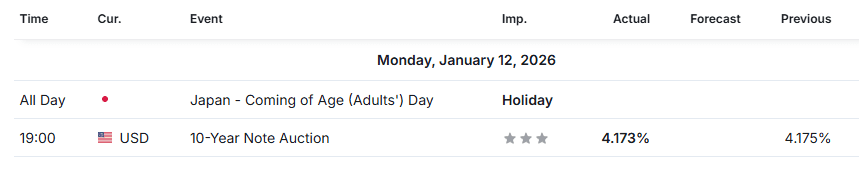

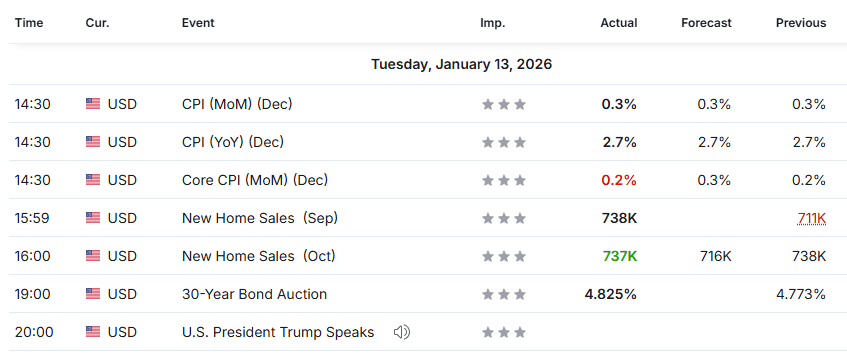

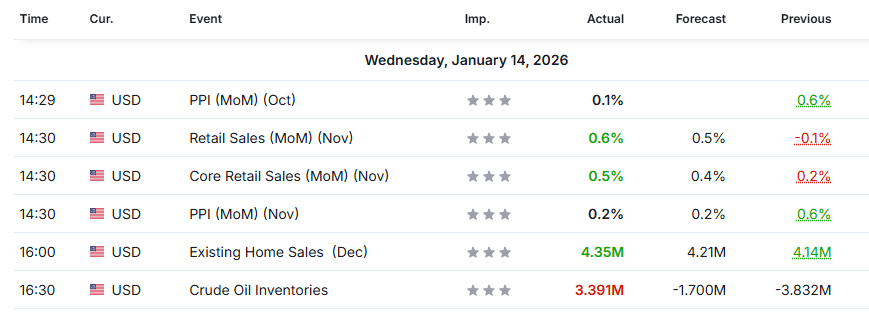

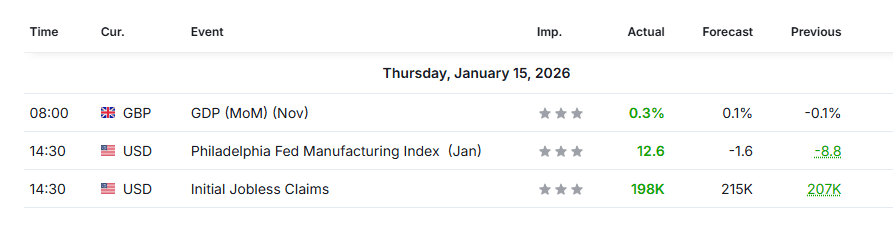

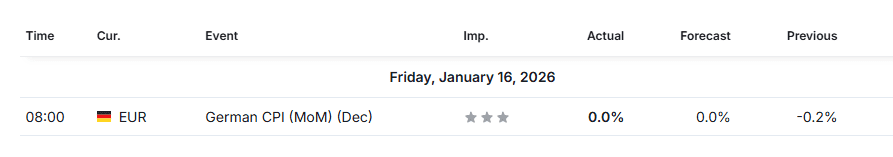

📅 Thursday, 12 Jan to 16 Jan 2026

Choppy market

No tredes this week.

WEEK 4🌐

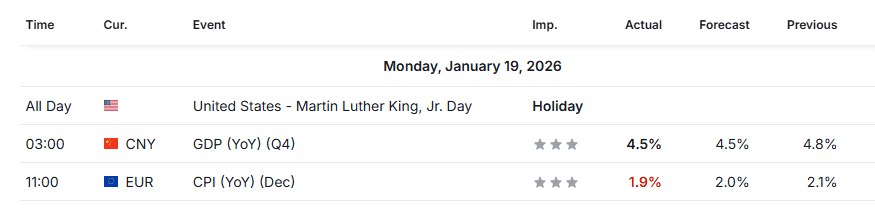

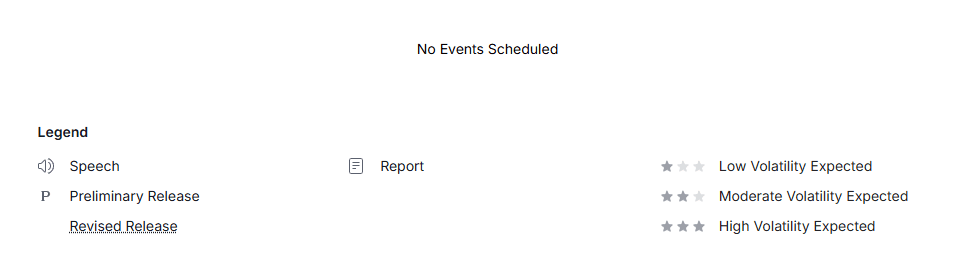

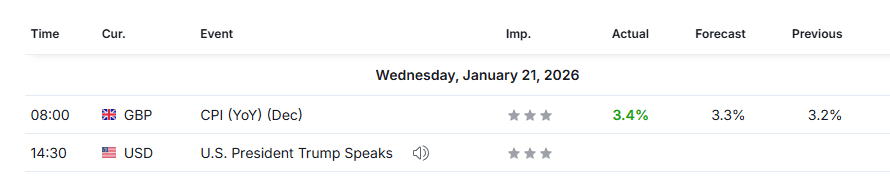

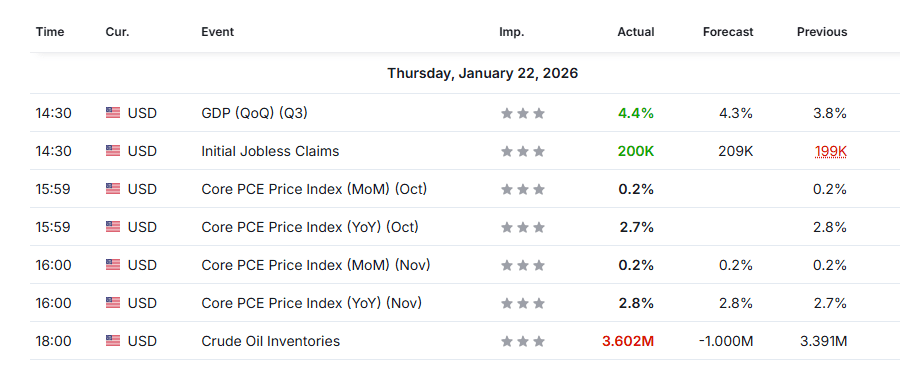

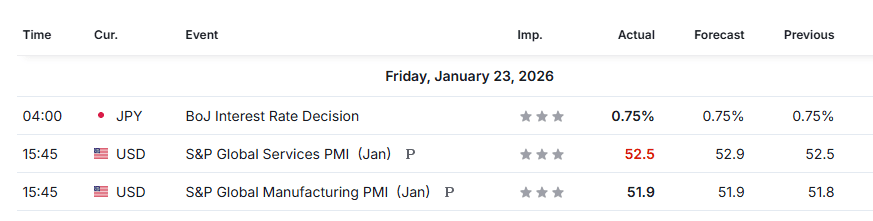

📅 Thursday, 19 Jan – 23 Jan 2026

Worst week this year

Textbook news fake, ubt I didn’t follow own rules and trade without waiting for confirmation…

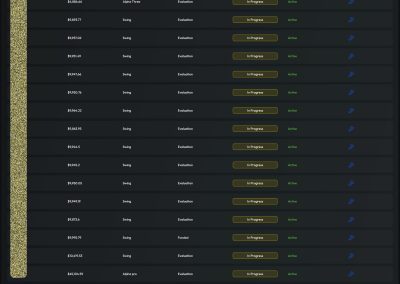

End-of-Day Review:

15 accounts -147 eur!! Real -600 floating profit! worst week.

15 accounts -147 eur and 2 open positions in real account with 600+ eur floating negative profit. Worst week in last few months. Breaking all own rules I follow. This week was the Swiss meeting with Trump and all big players. Trump want’s Greenland!! End of the week Asia meeting Trump-Zelensky Ukraine WAR negotiations.

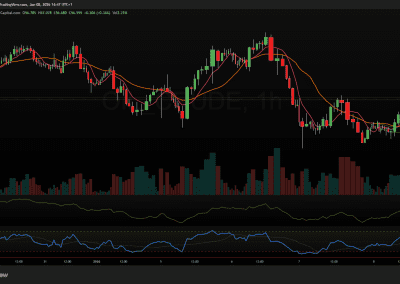

Quick visual overview of the day for major symbols

Daily Trading Reflection:

Timeframe

Only 5-minute timeframes and higher. Too much on 5 min!!

Trade Type

Swing trade

Market Context

Pullbacks on BULL market / failed.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, 3 TRADES, all short – deep profit lose (more than 2% on real account).

Lesson / Takeaway

Don’t trade news, but technical and follow system.

Next Step

Exit trade, when you see it is losing trade winthout negotiations!

➡ Open Positions Gallery

Gallery description: If you see the thumbnail, I didn’t open any positions (Thumbnail = no trades).

5 minute candle chart quick price action video

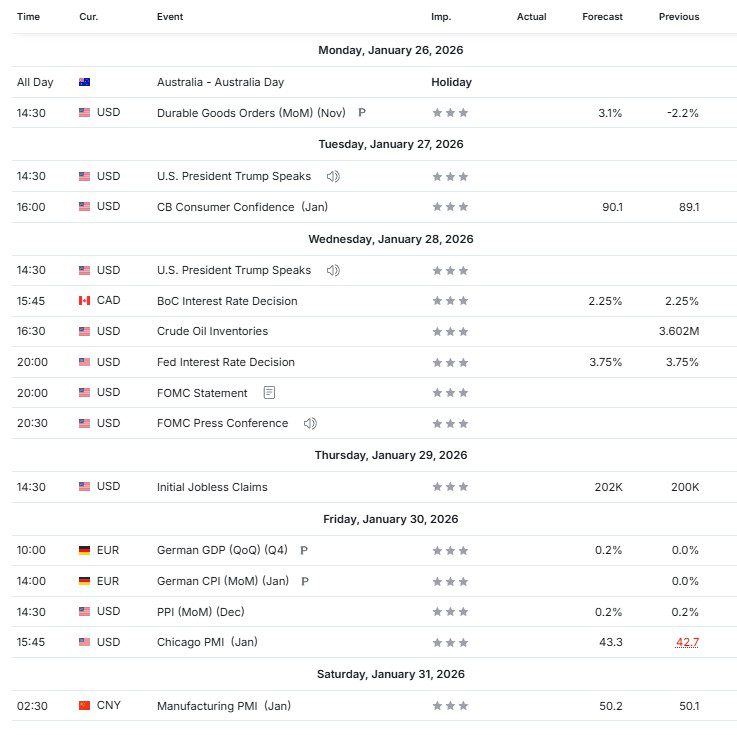

WEEK 5🌐 Bullish Expectations

📅 Monday, 26 Jan 2026

Optimism validated

Text here.

A longer summary of the day:

Text goes here.

Quick visual overview of the day for major symbols

Daily Trading Reflection:

Timeframe

Only 5-minute timeframes or higher

Trade Type

Scalp trade

Market Context

Pullbacks on sell market.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, many trades, about 150 eur profit. One very BAD trade, but with small LOT so no big lose. I close position from fear.

Lesson / Takeaway

Too much waiting at the start of US session, didn’t hold A+ position from EU session.

Next Step

Stay in trade longer when I lock in profit.

Quick taken positions overview

📅 Friday, 30 Jan 2026

A rough start to the year, entering the second week with optimism

Text!

End-of-Day Review:

Title text!

Text!

Quick visual overview of the day for major symbols

Daily Trading Reflection:

Timeframe

Only 5-minute timeframes or higher

Trade Type

Scalp trade

Market Context

Pullbacks on sell market.

Key Levels

-

Support: /

-

Resistance: /

-

Additional zones or comments: /

Trade Setup

Waiting for quick in-and-out scalp positions.

Outcome

XAUUSD trades, many trades, about 150 eur profit. One very BAD trade, but with small LOT so no big lose. I close position from fear.

Lesson / Takeaway

Too much waiting at the start of US session, didn’t hold A+ position from EU session.

Next Step

Stay in trade longer when I lock in profit.

Quick taken positions overview

Gallery description: If you see the thumbnail, I didn’t open any positions (Thumbnail = no trades).

5 minute candle chart quick price action video